In today’s article, we will be discussing an important tax form called the 1099. If you are not familiar with this form, don’t worry, we will explain all the different types and their significance. So, let’s dive in!

Understanding Form 1099

The 1099 form is a series of documents that the Internal Revenue Service (IRS) uses to report various types of income, other than traditional wages, salaries, and tips. These forms are filled out by a wide range of entities, including employers, businesses, and individuals, who are required to report certain types of income to the IRS.

The 1099 forms serve as informational returns, detailing the income earned by the recipient. This information is then used by the IRS to ensure that individuals and businesses are accurately reporting their income and paying the appropriate amount of taxes.

The Different Types of 1099 Forms

Now that we understand the purpose of the 1099 forms, let’s explore some of the most common types:

1. Form 1099-NEC

Form 1099-NEC is used to report non-employee compensation. It is typically filed by businesses that have paid an individual or a company $600 or more for their services during the tax year.

Form 1099-NEC is used to report non-employee compensation. It is typically filed by businesses that have paid an individual or a company $600 or more for their services during the tax year.

2. Blank 1099 Form

The Blank 1099 Form is a printable form that can be filled out manually. It is a convenient option for individuals or businesses that prefer to file their 1099 forms offline.

The Blank 1099 Form is a printable form that can be filled out manually. It is a convenient option for individuals or businesses that prefer to file their 1099 forms offline.

3. Form 1099-MISC

Form 1099-MISC is used to report miscellaneous income, such as rent, royalties, or other types of income that do not fall under any specific category.

Form 1099-MISC is used to report miscellaneous income, such as rent, royalties, or other types of income that do not fall under any specific category.

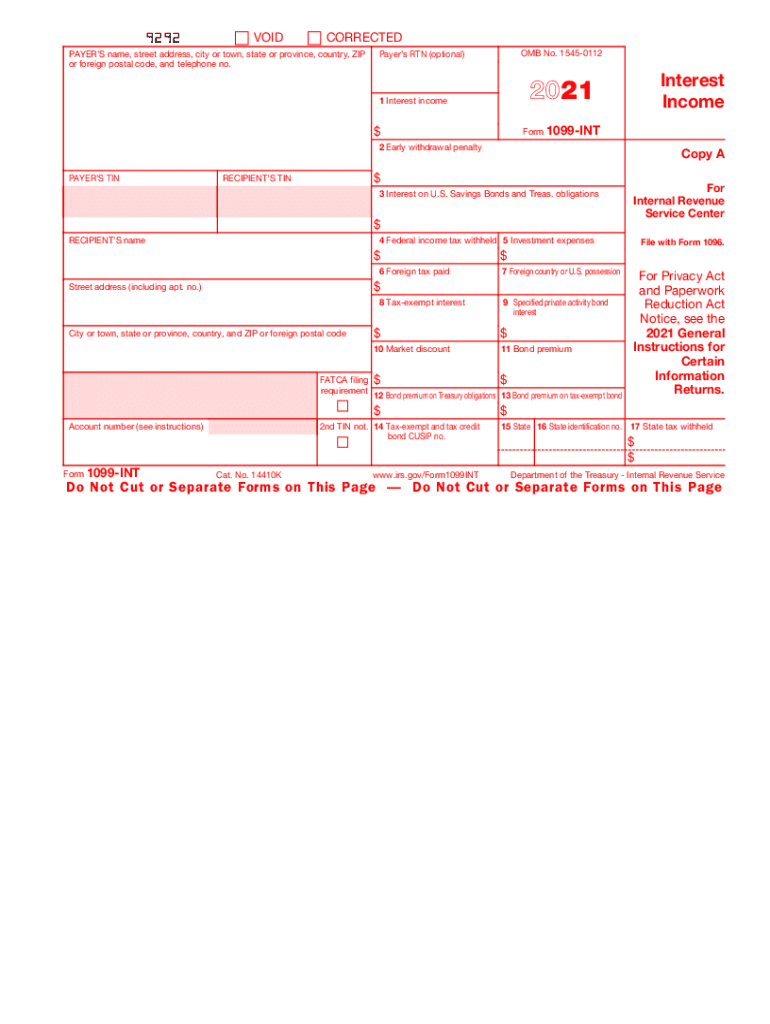

4. Form 1099-INT

Form 1099-INT is used to report interest income earned from various sources, such as savings accounts, certificates of deposits, or loans.

Form 1099-INT is used to report interest income earned from various sources, such as savings accounts, certificates of deposits, or loans.

Why are 1099 Forms Important?

The 1099 forms play a crucial role in the income reporting process. They ensure that all income, including non-traditional sources, is documented and taxed appropriately. The IRS compares the information reported on the 1099 forms with the tax returns filed by individuals and businesses.

By cross-referencing this information, the IRS can identify any discrepancies or unreported income. Failing to report income can lead to penalties, fines, or even an audit by the IRS. Therefore, it is essential to accurately report all income on the appropriate 1099 form.

Filing and Receiving 1099 Forms

If you are an individual who has received income reported on a 1099 form, it is vital to include this information when filing your tax return. You will need to report the income and pay any associated taxes.

On the other hand, if you are a business or self-employed individual who has made payments that require reporting on a 1099 form, you must provide the recipient with a copy of the form and submit it to the IRS.

Final Thoughts

In conclusion, the 1099 forms are an important aspect of the tax reporting process. They ensure that all income, not just traditional salaries, is accounted for and taxed appropriately. Whether you are an individual or a business, it is crucial to understand the different types of 1099 forms and their requirements.

Make sure to consult with a tax professional or utilize tax software to accurately report your income and file the appropriate 1099 forms. By doing so, you can avoid any potential penalties or issues with the IRS.

Remember, it is always better to be proactive and compliant when it comes to your taxes. So, stay informed, keep accurate records, and fulfill your tax responsibilities with confidence!